Think of a tariff like a tax at the border.

When the United States buys something made in another country (an import), it sometimes forces the foreign seller to pay extra money (a tariff) before their goods can enter. That extra cost typically ends up being shared between the buyer, seller, and sometimes someone in between.

Tariffs are one of the tools countries use when they want to protect local industries, respond to perceived unfair trade practices, or push for political goals.

What’s New — Recent U.S. Tariffs You Should Know About

Here are some of the latest tariffs (2025) the U.S. has introduced, and who they’re affecting: (just basic examples for reference. There are many otherwise. Next article will be about that)

Reciprocal tariffs

Goods from Brazil, Canada, etc.

“Reciprocal” means the U.S. wants other countries to lower their tariffs on U.S. goods. So the U.S. is raising its tariffs in response.

Tariffs on all imports from Canada & Mexico

The U.S. imposed ~25% tariffs on most imports from Canada & Mexico (some exceptions for energy).

Steel & Aluminum Tariffs

Steel, aluminum from abroad

The U.S. reinstated 25% tariffs on foreign steel and aluminum.

Tariff on goods from countries importing Venezuelan oil

All goods from those countries

The U.S. passed an order making any country that imports Venezuelan oil pay a 25% tariff on goods they export to the U.S.

These are just some examples — there are more variations, exceptions, and adjustments depending on trade deals, negotiations, and diplomacy.

How Tariffs Actually Impact People — The Real Effects

Let’s see how these border taxes ripple out in everyday life. Think of this as “from policy to your pocket.”

1. Prices Go Up for Buyers

When a tariff is imposed, the cost for the foreign seller or importer increases. Many times, that cost is passed down to the final buyer. So:

If you buy something made abroad (clothes, electronics, raw materials), it may cost more in the U.S. Businesses using imported parts will see their costs rise, and they may raise their prices too.

2. Local Producers May Get a Boost (Sometimes)

One goal of tariffs is to help domestic industries compete:

If imported steel becomes more expensive, U.S. steel makers may find they can sell more. Local factories or smaller industries may revive when cheap foreign alternatives are taxed.

However — this boost is not guaranteed. It depends on whether local producers can deliver quality, scale, and costs close to what importers provided before.

3. Trade Tensions & Retaliation

When one country imposes tariffs, other countries often retaliate with their own tariffs.

Canada & Mexico responded with their own taxes on U.S. goods. Other nations may protest via the World Trade Organization or take diplomatic or economic action.

This back-and-forth raises uncertainty for exporters, importers, and entire industries.

4. Lower Imports, Disrupted Supply Chains

Tariffs discourage imports — either because goods become too expensive or sellers don’t want to deal with the new rules.

Companies that relied on parts from abroad must find new suppliers (often slower or more expensive). Delivery delays increase, costs pile up, and inventories may need to be larger. For instance: researchers at Yale estimated that recent U.S. tariffs have increased delivery delays, which contributed to output losses and higher prices.

5. Government Revenue Increases (Short Term)

When people or companies pay tariffs, the government collects that money.

In 2025 (by August), the U.S. collected **~ US$146 billion** in net customs duties (from all tariffs) — a big rise over earlier years. That extra revenue can help reduce deficits or fund government programs — but relying on it long-term is risky, because tariffs also hurt trade and growth.

6. Growth & Economic Slowdown

Because trade gets expensive and uncertain, economic growth can slow:

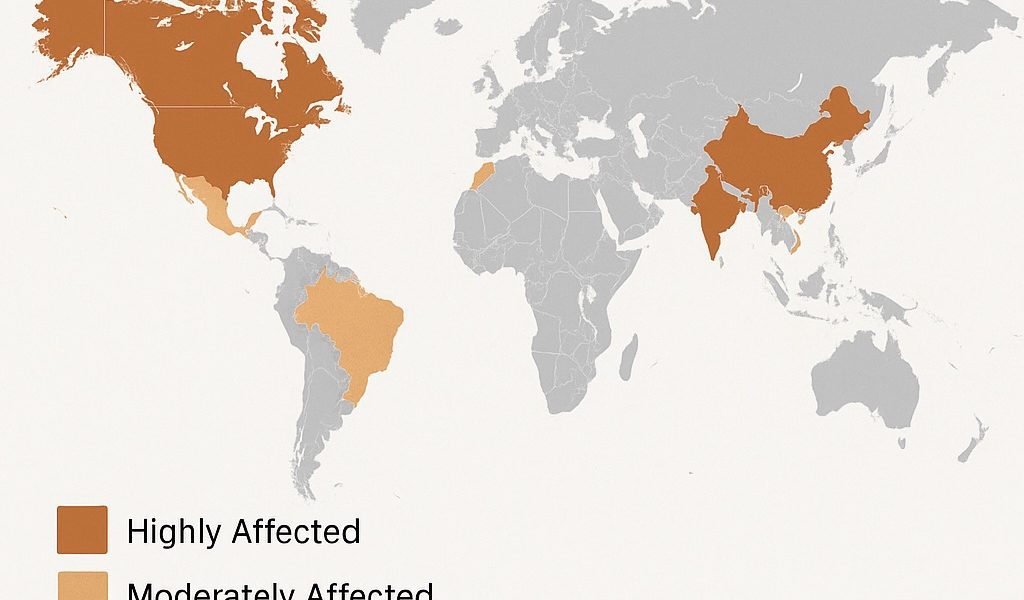

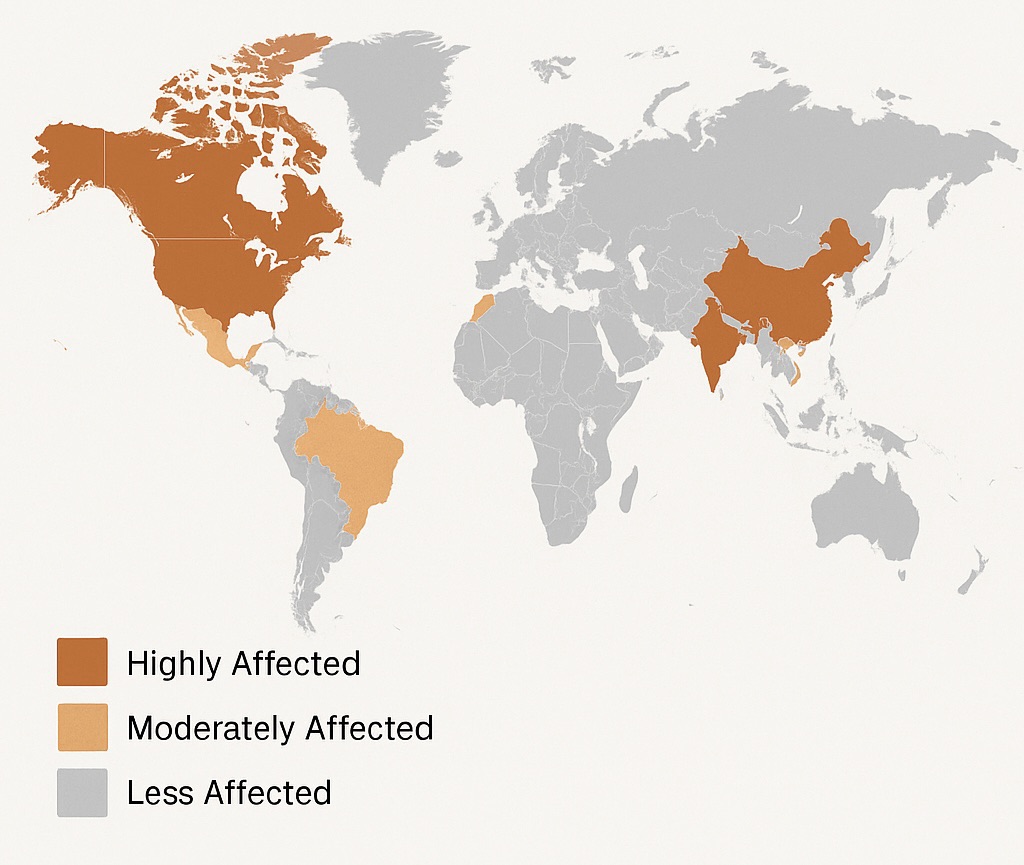

The IMF has cut growth forecasts for many countries, pointing to high U.S. tariffs as a drag on global growth. Countries that rely heavily on exports to the U.S. may suffer: fewer orders, job losses, scaling back factories. In South Asia, for example, the World Bank warns that new U.S. tariffs on Indian exports could slow regional growth.

Putting It All Together — A Story

Let’s imagine a simple story to see how a tariff can travel through real life:

A U.S. car company uses steel from Country X. The U.S. imposes a tariff on steel imports. Country X’s steel now costs more when sold in the U.S. The car company’s cost to build cars goes up. To maintain margins, they raise prices for buyers or reduce features. Fewer people buy cars, or they buy cheaper models. The car company may reduce its workforce or delay new manufacturing. Country X’s steel industry loses the U.S. market, maybe laying off workers. Country X retaliates with tariffs on cars or other goods from the U.S. The U.S. exporters lose market share in Country X, etc.

This “ripple effect” can stretch across continents, impacting many industries and individuals.

Why This Matters to You — No Matter Where You Live

If you’re a consumer, you may pay more for foreign-made goods. If you’re a business owner, especially in manufacturing or trade, you’ll need to re-think sourcing, costs, and markets. If your economy heavily relies on exports to the U.S., a tariff by the U.S. can hit jobs, incomes, and growth. If you’re a policy thinker or citizen, tariffs remind us how interconnected the world is: what one government does affects millions elsewhere.