Here’s something nobody tells you when you’re celebrating that first big revenue milestone: your financial operations are probably already becoming your worst enemy. Think about it. When you’re pulling in $500K annually, managing books feels almost… manageable. But fast-forward to processing hundreds of invoices every month? That’s when reality hits hard.

Your finance team if you even have one is buried under data entry, reconciliation nightmares, and approval chasing that never seems to end. Meanwhile, the strategic analysis that could actually move the needle on growth? It’s sitting on the back burner, gathering dust.

This isn’t just about inefficiency annoying you. It’s genuinely limiting how fast you can grow. You’re stuck making impossible choices: hire another accountant or accept that your financial insights will always lag weeks behind reality.

The Growth Challenge: Watching Your Finance Operations Crumble Under Pressure

Growth sounds great in theory. In practice? It exposes every crack in your financial foundation. Most service business owners don’t even realize their money management systems are broken until cash flow problems and credibility hits start piling up.

When Everything Falls Apart

Different revenue stages bring totally different headaches. Picture this: at $500K, you’re probably still rocking spreadsheets and maybe a part-time bookkeeper who comes in twice a month. Comfortable enough.

Then you hit $1M, and suddenly monthly reconciliations eat up two full weeks. Every. Single. Month. The pressure intensifies fast research shows IT leaders estimate their organizations risk losing over $9.5m annually when digital transformation efforts fail.

Service businesses face something uniquely challenging. Each client engagement creates its own messy financial trail. You’re juggling project budgets, billable hours, expense splits, and revenue recognition across potentially hundreds of active projects simultaneously. It’s exhausting.

What Financial Chaos Actually Costs You

This is precisely where financial process automation shifts from “nice to have” to “absolute necessity for survival.” Manual workflows hide costs that multiply as you scale. Delayed invoicing stretches your cash conversion cycle. Billing mistakes wreck client relationships. Finance team burnout leads to expensive turnover cycles.

These aren’t small annoyances, they’re strategic vulnerabilities threatening your entire operation.

The missed revenue opportunities sting worst. When your quote-to-cash process takes weeks instead of days because someone’s manually forwarding approval emails, you’re basically offering free financing to every client. Plus, your team lacks bandwidth to analyze which service offerings actually generate healthy margins.

The Moment Spreadsheets Become Dangerous

Let’s be honest: spreadsheets were never built for complex, multi-layered financial operations. They completely break down when you need instant visibility across projects, departments, and legal entities. Version control turns into a daily nightmare. Formula errors spread like weeds. Audit trails vanish into thin air. What felt adequate at $1M revenue becomes actively dangerous at $5M.

Core Financial Processes Begging for Automation

Smart service businesses zero in on specific workflows where automation delivers immediate, measurable returns. You don’t need everything automated on day one. But certain processes create value that compounds over time.

Transforming Billing and Invoicing

Automated systems completely transform how quickly you convert delivered work into actual cash. Retainer-based services benefit enormously from recurring billing automation that eliminates manual invoice creation each billing cycle. Project-based businesses need systems automatically pulling time-tracking data, applying client-specific rates, and generating invoices without anyone lifting a finger.

Integration with project management platforms means your billing automatically reflects actual delivery. Usage-based billing suddenly becomes feasible for variable service models. Payment reminders and collections management happen on schedule without anyone needing to remember.

Streamlining Expense Management and Approvals

Get this: finance teams waste up to 80% of their time just collecting and verifying data, leaving almost nothing for actual analysis and strategic planning.

Real-time expense capture through mobile apps and corporate card integrations eliminates the endless receipt-chasing game. Multi-level approvals trigger automatically based on amount thresholds and policy rules you define once.

Receipt matching and policy compliance enforcement happen instantly instead of during those painful monthly review meetings. You catch problems before they morph into expensive mistakes on financial statements.

Unlocking Real-Time Reporting and Analytics

Here’s where modernizing operations with financial process automation delivers your strongest competitive advantages. Real-time dashboards replace those week-long manual report compilation marathons. Month-end close processes that historically took fifteen grueling days now wrap up in three.

Client profitability tracking reveals which relationships deserve nurturing and which are quietly draining resources.

Predictive cash flow forecasting leverages historical patterns to project future positions with real accuracy. This goes beyond speed; it’s about having trustworthy data exactly when critical decisions need making.

Strategic Advantages of Workflow Automation

The genuine payoff from automation extends far beyond just operational efficiency improvements. It fundamentally reshapes what becomes possible as you scale aggressively.

Accelerating Cash Flow

Reducing days sales outstanding through faster invoicing directly improves working capital. When invoices go out the same day work gets completed instead of two weeks later, you’re essentially giving yourself an interest-free loan. Automated subscription renewals and upsell triggers capture revenue that would otherwise slip through unnoticed.

Payment gateway integration enables instant collection for specific service types. Real-time revenue visibility across multiple service lines helps you double down intelligently on what’s actually working.

Gaining True Financial Visibility

Scaling successfully requires information you can trust immediately, not next week. Leadership teams need real-time financial KPIs accessible through dashboards, not emailed spreadsheets with questionable formulas. Client and project profitability insights drive strategic planning decisions about which markets merit entering and which should be abandoned.

Resource allocation becomes data-driven rather than gut-driven. Scenario modeling for expansion and investment decisions uses actual financial patterns instead of hopeful projections.

Scaling Without Proportional Cost Increases

This is where automation becomes genuinely transformative. Processing 10x transaction volume with the same finance team size means your unit economics improve dramatically as revenue grows.

You’re not adding accounting headcount proportionally with revenue; a three-person team managing $2M can often handle $15M with smart automation.

Standardized processes work across offices and regions without customization for each location. Self-service client portals reduce support burden by letting clients access their own financial information.

Implementation: Actually Getting Started

Most service businesses struggle identifying where to begin. The key is pinpointing high-impact opportunities matching your current growth stage.

Auditing Current Processes

Run a comprehensive financial process audit focused on time drains and error rates. Track precisely how many hours your team spends on recurring tasks like invoice generation, expense approvals, and reconciliation. Identify bottlenecks where work sits idle waiting for human intervention.

Document pain points through stakeholder interviews with both finance team members and people interacting with finance processes.

Calculate potential ROI for different automation initiatives. Quick wins with measurable impact build momentum for larger transformation projects.

Choosing the Right Tools

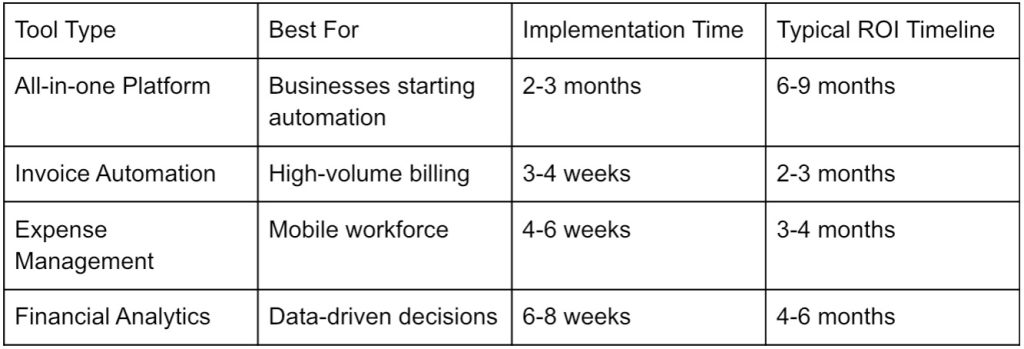

The decision between all-in-one platforms versus best-of-breed specialized tools depends entirely on your specific needs. Cloud-based solutions typically offer faster implementation and lower upfront costs compared to on-premise options. Integration capabilities with your existing tech stack matter infinitely more than feature lists; the “best” tool that won’t connect to your ERP creates new problems.

Evaluate scalability and pricing models carefully. What makes sense at $2M revenue might not work at $10M. Industry-specific solutions for agencies, consulting firms, or MSPs often understand your workflows better than generic tools.

Real-World Success Metrics That Matter

Numbers tell the story better than promises ever could. Service businesses implementing automation see remarkably consistent patterns in results.

Quantifiable Impact You Can Track

Invoice processing time typically drops 70-80% once automation handles data entry and routing. Days sales outstanding improvements of 15-30 days are common when invoicing happens immediately after service delivery. Finance team productivity gains of 40-60% let the same people handle significantly higher transaction volumes. Error rates decrease by 90%+ when humans aren’t manually entering data.

Actual Scaling Success Stories

Real examples prove what’s genuinely possible. Agencies growing from $2M to $15M with the same three-person finance team aren’t unicorns; they’re businesses that automated before scaling became urgent. Consulting firms reducing month-end close from fifteen days to three days gain strategic agility creating genuine competitive advantages.

MSPs achieving 99% on-time invoice delivery through automation improve client satisfaction while accelerating cash collection.

Your Burning Questions About Finance Automation

What’s the realistic ROI timeline for implementing financial process automation?

Most service businesses see positive ROI within 3-6 months for targeted automations like invoicing or expense management. Comprehensive implementations across multiple processes typically break even within 6-12 months, with compounding returns as transaction volumes increase over time.

Which financial processes should service businesses automate first?

Start with automated billing and invoicing if cash flow is your primary concern, or expense management if you’re drowning in policy compliance and reimbursement delays. Pick the area causing the most daily pain for your team right now.

Can small service businesses under $1M revenue actually benefit from financial automation?

Absolutely, especially if you’re growing quickly. Early automation prevents developing manual habits that become incredibly expensive to break later. Focus on cloud-based tools with pay-as-you-grow pricing rather than enterprise platforms demanding minimum commitments.

Moving Forward with Confidence

Growing service businesses simply can’t afford treating financial operations as an afterthought anymore. Manual processes working fine at smaller scales become active obstacles when you’re trying to double revenue without doubling overhead costs. The businesses thriving through aggressive growth spurts are the ones that automated their financial workflows before they absolutely had to.

They’re collecting cash faster, closing books quicker, and making strategic decisions with real-time data instead of weeks-old spreadsheets. The question isn’t whether you’ll eventually automate, it’s whether you’ll do it proactively or reactively when manual processes finally collapse under their own weight. Choose wisely.