Exploring Bitcoin Price Patterns: Charting the Course

When the world chose to accept Bitcoin as the ultimate pioneer in digital currency, some people made fortunes from trading while others remained the same. So what made the difference? Well, reading the price of Bitcoin via crypto chart patterns for once!

When the world chose to accept Bitcoin as the ultimate pioneer in digital currency, some people made fortunes from trading while others remained the same. So what made the difference? Well, reading the price of Bitcoin via crypto chart patterns for once!It may sound simple but it is anything so because to read these price patterns, you need a sound understanding of the charts and patterns.

So sit back and get into the details of the different price patterns of the Bitcoin network charts and what they mean to us.

Bitcoin Price Pattern Chart Analysis?

In trading crypto, it is important to understand what position you would like to take (short or long) to make calculated decisions and reduce risk. This is where using charts can give timely insights into buying Bitcoin cash.

Technical analysis works wonders in helping users assess the price dynamics and chart patterns in spotting trading opportunities and understanding Bitcoin protocol.

It is all about studying past trading activity that can help with Bitcoin price prediction for future movements.

Bitcoin prices pattern analysis is crucial as it helps traders interpret charts for a better understanding of herd mentality and utilizing the cryptocurrency. Bullish or bearish movements are core parts of the crypto market tapestry when discussing the rise or fall of Bitcoin price USD.

Bitcoin prices pattern analysis is crucial as it helps traders interpret charts for a better understanding of herd mentality and utilizing the cryptocurrency. Bullish or bearish movements are core parts of the crypto market tapestry when discussing the rise or fall of Bitcoin price USD. When your digital asset has a stable increase, it indicates excitement and optimism for the market. Yet a downward motion reflects a glum market outlook ergo putting pressure on the sellers.

Therefore, knowing how to read the patterns is key to making smart decisions that will bear long-term fruit for the Bitcoin blockchain technology.

Reading Crypto Charts for Bitcoin Patterns

Crypto charts have become a critical weapon for users who wish to trade their digital assets and asses Bitcoin price today.

Traders commonly use three charts for ensuring smart Bitcoin transactions and activity; bar charts, line charts, and of course the famous candlestick charts.

Let's explain these below

Bar Chart

The bar chart has various price bars and each bar represents the performance of price over a certain time period. With a bar chart, you get a visual depiction of Bitcoin’s price fluctuations during a specific time frame.

Line Chart

Line chart (or graph chart) is another visual representation of Bitcoin’s price history utilizing a continuous line. This chart shows information from a data series connected by line segments.

Candlestick Charts

When it comes to popularity and value, candlestick charts take the lead. This chart has candles depicting price uptrends or downtrends within a time duration.

A candlestick entails a body with its wick. The former shows where the prices opened and ended and the latter tells you when the price of Bitcoin went highest within a specific time period. However, the bottom wick shows the lowest the price went within a duration.

Next comes the candle's colors, which are quite significant. Red depicts that the price fell, green candle shows when the price went high.

Bitcoin Price Patterns To Know

As we cleared up the chart types, now it is time to talk about the patterns to understand the Bitcoin foundation further.

Crypto charts can form various patterns to help traders evaluate things and make a decision. A price pattern is a shape formed in a chart that can hint about upcoming price movements based on previous trends.

These chart patterns are essentially the foundation of technical analysis, making them immensely valuable to traders for predicting price trends.

Below are the various pattern classifications for your understanding:

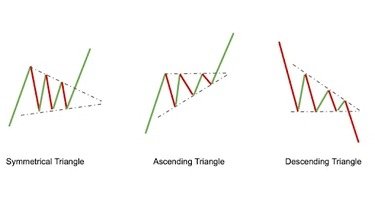

Ascending Triangle and Descending Triangle Pattern

These are continuation patterns. Ascending and descending triangles happen with a horizontal resistance line that links the highs and lows. There is a second trend line that connects increasing highs and dipping lows.

The resulting triangle reaches a decision point where the price can either erupt or crash from this horizontal line in the direction of the sloped line.

The Head and Shoulders Pattern

A reversal pattern. This has three peaks, the middle peak ( head) that goes higher than the remaining two (shoulders). The line that connects the lows of the two shoulders is the ‘neckline’.

A break below this neckline shows a potential reversal in a downward trajectory.

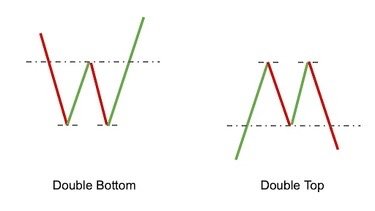

Double and Triple Tops/Bottoms Pattern

The double and triple top patterns show that after reaching a high price twice and thrice respectively, the market may not go higher, suggesting a drastic trend change from high to low. Similarly, the opposite happens in the double and triple bottom pattern where after reaching a certain low price, the market may not go lower (trend going from low to high).

The Head and Shoulders Pattern

A reversal pattern. This has three peaks, the middle peak ( head) that goes higher than the remaining two (shoulders). The line that connects the lows of the two shoulders is the ‘neckline’.

A break below this neckline shows a potential reversal in a downward trajectory.

Double and Triple Tops/Bottoms Pattern

The double and triple top patterns show that after reaching a high price twice and thrice respectively, the market may not go higher, suggesting a drastic trend change from high to low. Similarly, the opposite happens in the double and triple bottom pattern where after reaching a certain low price, the market may not go lower (trend going from low to high).

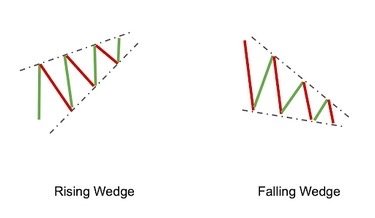

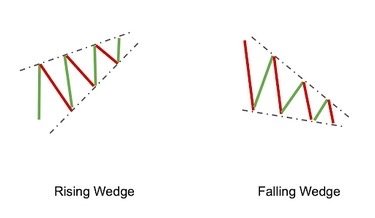

Wedges

Wedges can be continuation or reversal patterns and they happen every time the trend lines converge. The rising wedge is a bearish indicator, while a falling wedge is a bullish indicator.

Cup and Handle Pattern

This is a continuation pattern. It resembles the shape of a teacup, with a rounded bottom (the cup) followed by a smaller indecisive market period (the handle).

Wedges can be continuation or reversal patterns and they happen every time the trend lines converge. The rising wedge is a bearish indicator, while a falling wedge is a bullish indicator.

Cup and Handle Pattern

This is a continuation pattern. It resembles the shape of a teacup, with a rounded bottom (the cup) followed by a smaller indecisive market period (the handle).

The right area of this pattern shows a low trading volume and this could go on for 6 – 64 weeks duration.

Conclusion

Studying Bitcoin price patterns can aid in predicting future movements. Whether you identify continuation or reversal patterns, you can wield these insights to guide your crypto buying and selling decisions.

However, patterns must be used alongside other analysis tools and risk management techniques so you can wade through Bitcoin's volatility and come out triumphant.

Conclusion

Studying Bitcoin price patterns can aid in predicting future movements. Whether you identify continuation or reversal patterns, you can wield these insights to guide your crypto buying and selling decisions.

However, patterns must be used alongside other analysis tools and risk management techniques so you can wade through Bitcoin's volatility and come out triumphant.

Copyrights © 2026 Inspiration Unlimited - iU - Online Global Positivity Media

Any facts, figures or references stated here are made by the author & don't reflect the endorsement of iU at all times unless otherwise drafted by official staff at iU. A part [small/large] could be AI generated content at times and it's inevitable today. If you have a feedback particularly with regards to that, feel free to let us know. This article was first published here on 13th April 2024.

Overthinking? Uninspired? Brain Fogged?

Let's Reset That! Try iU's Positivity Chat NOW!

All chats are end-to-end encrypted by WhatsApp and won't be shared anywhere [won't be stored either].