6 Secrets for Financial Stability

How do financially stable people get that way? It doesn't happen overnight but is the result of a long-term series of wise decisions. If you aim to put your money matters in order and create a more sound, secure base for future financial health, it's possible to begin now. To be on the safe side, partner up with a debt management professional such as the London insolvency practitioners Hudson Weir. You won't see immediate results, of course, but can realistically expect to witness visible changes in your situation within just a few months. After that, the success of your efforts is completely dependent on your long-term discipline, perseverance, and dedication.

How do financially stable people get that way? It doesn't happen overnight but is the result of a long-term series of wise decisions. If you aim to put your money matters in order and create a more sound, secure base for future financial health, it's possible to begin now. To be on the safe side, partner up with a debt management professional such as the London insolvency practitioners Hudson Weir. You won't see immediate results, of course, but can realistically expect to witness visible changes in your situation within just a few months. After that, the success of your efforts is completely dependent on your long-term discipline, perseverance, and dedication.Are you ready to begin? Study the following six techniques and implement the ones that pertain to your particular situation. Most people discover they can instantly bring a dose of calm to an otherwise hectic scenario by choosing to take action and put some of the following suggestions into practice.

Negotiate Tax Debts

If you owe any money to the IRS and are not on a payment plan, contact them at their toll-free phone number as soon as possible. For starters, the number is easy enough to remember: 1-800-829-1040. The "829" part spells "tax," 1040 refers to the ever-so-popular form that hundreds of millions of people fill out every April. Wait to go through all the prompts until you're able to speak with a human. Explain your situation clearly and

honestly. Ask what your options are. You might be surprised at the number of helpful arrangements available. If you owe less than $10,000, it's usually possible to get on a monthly plan that makes sense for your budget. If you owe more than that, you might be able to make a partial offer for settlement of the entire amount.

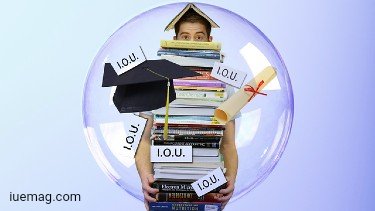

honestly. Ask what your options are. You might be surprised at the number of helpful arrangements available. If you owe less than $10,000, it's usually possible to get on a monthly plan that makes sense for your budget. If you owe more than that, you might be able to make a partial offer for settlement of the entire amount.Consolidate Student Loans

Do you owe money on education loans? If you have several outstanding debts to different lenders, do a little research online about the advantages of consolidation. It's interesting to note that when you work with a private lender to put all your student loans together, you can simplify your financial life quickly and easily. If you're not sure what consolidation entails or exactly how it works, there's an online guide you can read to get a better understanding of the details. For anyone who owes on multiple education loans, it makes good sense to consolidate.

Buy a Reliable Used Car

For some, giving up the idea of driving a brand-new car every couple of years is a hard pill to swallow. But getting your money matters in order often involves some even harder decisions. The great news is that you won't regret breaking the new car habit. Step one is to pay off, sell, get rid of, or otherwise separate yourself from your new, high-payment vehicle. Next, or shortly before saying goodbye to the pricey vehicle, set aside enough money to purchase a reliable used car. Even if it takes you several months to accomplish this chore, do it and don't look back. What are the rewards? No car payment, for starters. No high insurance premiums for a car that is partially owned by a bank or lender. And no interest payments draining your monthly budget. It's a win-win situation if ever there was one.

Plug the Holes in Your Budget

Go through your budget with a magnifying glass and identify at least one place where you can eliminate some fat. For most folks, it's the trickle of money flowing out for fast-food and convenience store spending. Eating out and unplanned spending are the two issues of personal finance. Another quick-fix that works is to join a shopping club and buy all your groceries there. The small annual fee is minimal compared to what you can save on a yearly basis.

Minimize Credit Card Use

Don't chop up your credit cards and throw them in the garbage like the crazy guy on television does in the infamous infomercial. Instead, learn to use credit responsibly. Pay off your highest interest cards first. Then, slowly work to pay all the other balances within a year. Strive to have no more than two credit cards in your life.

Work on Your Credit Score

Keep credit card usage low. Pay all your bills on time. Check your scores with the three major bureaus at least three times per year. There are free online programs you can sign up with that can show you all your scores from week to week. Within about six months, you can start to see your scores inch up. You can also check thefinanceshub.com for more tips on how to improve your credit score.

Copyrights © 2026 Inspiration Unlimited - iU - Online Global Positivity Media

Any facts, figures or references stated here are made by the author & don't reflect the endorsement of iU at all times unless otherwise drafted by official staff at iU. A part [small/large] could be AI generated content at times and it's inevitable today. If you have a feedback particularly with regards to that, feel free to let us know. This article was first published here on 2nd December 2020.

Want to Publish About Your Business / Achievements

Let's Discuss Right Away!

All chats are end-to-end encrypted by WhatsApp and won't be shared anywhere [won't be stored either].