A Complete Guide About Kisan Credit Card

The Government of India keeps launching various schemes and plans to help the people below the poverty line, new entrepreneurs, farmers, and more. One of the schemes was established in 1998 to support the farmers called Kisan Credit Card.

The Government of India keeps launching various schemes and plans to help the people below the poverty line, new entrepreneurs, farmers, and more. One of the schemes was established in 1998 to support the farmers called Kisan Credit Card.Here we get to know all about the Kisan Credit Card, its key features, how does it help the farmer's Kisan Credit Card interest rates and more.

What is Kisan Credit Card?

The Kisan Credit Card is a government scheme that offers small and marginal farmers timely credit access. The aim of KCC, created by NABARD or the National Bank for Agriculture and Rural Development, is to furnish short-term credit to the farmers of India.

It was observed that the workforce needed credit in agriculture, fisheries, poultry, marine fisheries, aquaculture, dairy, and more. KCC helps them get short-term loans to purchase equipment and pay for several other expenses.

Kisan Online Credit Card also exempts the farmers from the high-interest rates. Under the Kisan Credit Card, the farmers are given loans at a meager interest rate. In the KCC, the rates start from as low as 2%. The farmers are permitted to repay their loans at their convenience.

What are the benefits of the Kisan Credit Card?

KCC is a well-thought scheme that offers numerous benefits to agricultural workers. Some of the top benefits of the Kisan Credit Card scheme are mentioned below:

- A farmer can borrow a loan of up to Rs.3 lakh and produce marketing loans.

- KCC scheme also comes with Insurance coverage. The holders get around Rs.50,000 if they suffer permanent disability or death. In other cases, they get the protection of Rs.25,000.

- Farmers get credit and can suffice their financial needs for maintaining agricultural and other activities.

- The credit is also provided for dairy animals, field equipment, and more.

- The farmers who receive KCC are given a savings account. Kisan credit card interest rate is low.

- The farmers can also use the amount to buy fertilizers, seeds, and more.

- KCC also helps the farmers get attractive cash discounts from the dealers.

- The farmers under the KCC scheme also get a smart card, a debit card, and the Kisan Credit Card.

- The borrower can pay the amount back in flexible hassle-free disbursement options.

- The scheme also offers a single credit facility and term loan to meet agricultural and ancillary needs.

- The farmers get credit for a period of up to 3 years. The farmers can repay the amount after the harvest season.

- One of the prime benefits of this scheme is that farmers need not submit any collateral for getting the loan up to Rs.1.6 lakh.

All About Kisan Credit Card Interest Rate

Unlike moneylenders, Kisan credit cards safeguard agricultural workers by charging a low-interest rate. Kisan Credit Card Interest Rates are very low at around 2.00% p.a. SBI Kisan Credit Card charges 7% P.A and Min. is 2% p.a while PNB Kisan Credit Card charges a Min. of 4% interest p.a. HDFC Bank Kisan Credit Card charges Max. 16.69% interest p.a. and Min. 9% p.a.

The things to know about interest rates when using the Kisan Credit Card are:

- If the payment is not made regularly, the bearer will pay compound interest.

- Also, if the repayment happens promptly, then a simple interest rate will be charged.

- The KCC holders get a 2% Interest subvention if they take a loan amount of Rs. 2 Lakh.

- Extra interest subvention of 3% is given to the KCC farmers to repay their dues on time.

Conclusion

As you can see, the benefits of Kisan Online Credit Card are many. The farmers had always struggled to pay the exorbitant interest rate the banks and moneylenders charged. With KCC, they can breathe a sigh of relief.

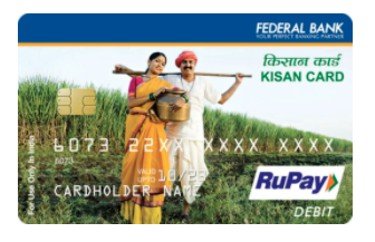

Image Credits:

Image 1: Federal Bank

Image 2: Image by brazil topno from Pixabay

Copyrights © 2025 Inspiration Unlimited - iU - Online Global Positivity Media

Any facts, figures or references stated here are made by the author & don't reflect the endorsement of iU at all times unless otherwise drafted by official staff at iU. A part [small/large] could be AI generated content at times and it's inevitable today. If you have a feedback particularly with regards to that, feel free to let us know. This article was first published here on 24th March 2022.

Overthinking? Uninspired? Brain Fogged?

Let's Reset That! Try iU's Positivity Chat NOW!

All chats are end-to-end encrypted by WhatsApp and won't be shared anywhere [won't be stored either].