Special Features

A collection that's special to our readers, contributors and us especially for special news.

Ad

Getting Out of the Red: A Comprehensive Guide to Debt Management

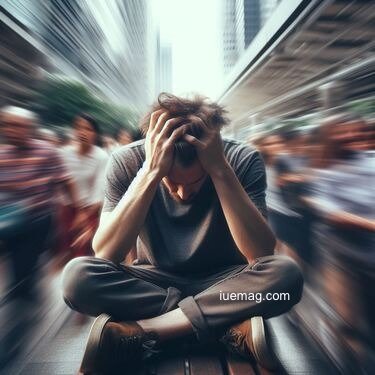

Debt can be a heavy burden, casting a dark shadow over our financial well-being. It can keep us awake at night, stress us out, and limit our ability to achieve our financial goals. But fear not, because in this comprehensive guide, we will explore the path to effective debt management, including paying off your Credit Card Debt and addressing Loans, helping you regain control of your finances, and working towards a debt-free life.

Debt can be a heavy burden, casting a dark shadow over our financial well-being. It can keep us awake at night, stress us out, and limit our ability to achieve our financial goals. But fear not, because in this comprehensive guide, we will explore the path to effective debt management, including paying off your Credit Card Debt and addressing Loans, helping you regain control of your finances, and working towards a debt-free life. So, let's dive in and uncover the strategies that can lead you out of the red and into a brighter financial future.

1. Assess Your Debt Situation:

Before you can tackle your debt, you need to know exactly what you're dealing with. Make a list of all your debts, including credit card balances and loans, and any outstanding bills. Note the interest rates and minimum payments for each. This snapshot of your financial situation will serve as the foundation for your debt management plan.

2. Create a Budget:

One of the most crucial steps in debt management is creating a budget. List your monthly income and expenses, making sure to include loan payments alongside credit card obligations. Allocate a portion of your income to debt repayment while ensuring that you have enough left for essential expenses like housing, groceries, and transportation. A well-balanced budget will help you stay on track.

3. Prioritize High-Interest Debts:

Not all debts are created equal. High-interest debts, such as credit card balances and loans, can cost you a significant amount of money in interest over time. Prioritize paying off these high-interest debts first. Allocate as much as possible from your budget towards these debts while making minimum payments on others.

4. Snowball or Avalanche Method:

There are two popular strategies for paying off multiple debts: the snowball method and the avalanche method. With the snowball method, you focus on paying off the smallest debt first and then move on to the next smallest.

There are two popular strategies for paying off multiple debts: the snowball method and the avalanche method. With the snowball method, you focus on paying off the smallest debt first and then move on to the next smallest.The avalanche method, on the other hand, prioritizes the debt with the highest interest rate. Choose the method that aligns with your financial goals and personality.

5. Consolidate Your Debt:

Consider consolidating your debts into a single, lower-interest loan or credit card. This can simplify your payments and potentially reduce your interest expenses. However, be cautious and make sure the terms of the consolidation are favorable before proceeding.

6. Negotiate with Creditors:

Don't hesitate to reach out to your creditors if you're struggling to make payments. They may be willing to work with you on a modified payment plan or even offer a settlement to reduce the total amount owed. It never hurts to ask, and it can make a significant difference in your debt management journey.

7. Cut Unnecessary Expenses:

Trimming your budget is essential when trying to get out of debt. Identify non-essential expenses and find ways to cut them. This might mean dining out less, canceling subscription services, or finding more cost-effective alternatives for your daily needs.

8. Increase Your Income:

Sometimes, getting out of debt requires more than just cutting expenses. Look for opportunities to increase your income. This could involve taking on a part-time job, freelancing, or selling items you no longer need. The extra income can accelerate your debt repayment efforts.

9. Build an Emergency Fund:

While it may seem counterintuitive to save money while in debt, having an emergency fund can prevent you from accumulating more debt when unexpected expenses arise. Start with a small emergency fund, such as $1,000, and gradually build it up as you pay off your debts.

10. Seek Professional Help:

If your debt situation feels overwhelming or you're unsure of the best course of action, consider seeking help from a financial counselor or advisor. They can provide expert guidance tailored to your specific circumstances and help you develop a personalized debt management plan.

Final Thoughts

5. Consolidate Your Debt:

Consider consolidating your debts into a single, lower-interest loan or credit card. This can simplify your payments and potentially reduce your interest expenses. However, be cautious and make sure the terms of the consolidation are favorable before proceeding.

6. Negotiate with Creditors:

Don't hesitate to reach out to your creditors if you're struggling to make payments. They may be willing to work with you on a modified payment plan or even offer a settlement to reduce the total amount owed. It never hurts to ask, and it can make a significant difference in your debt management journey.

7. Cut Unnecessary Expenses:

Trimming your budget is essential when trying to get out of debt. Identify non-essential expenses and find ways to cut them. This might mean dining out less, canceling subscription services, or finding more cost-effective alternatives for your daily needs.

8. Increase Your Income:

Sometimes, getting out of debt requires more than just cutting expenses. Look for opportunities to increase your income. This could involve taking on a part-time job, freelancing, or selling items you no longer need. The extra income can accelerate your debt repayment efforts.

9. Build an Emergency Fund:

While it may seem counterintuitive to save money while in debt, having an emergency fund can prevent you from accumulating more debt when unexpected expenses arise. Start with a small emergency fund, such as $1,000, and gradually build it up as you pay off your debts.

10. Seek Professional Help:

If your debt situation feels overwhelming or you're unsure of the best course of action, consider seeking help from a financial counselor or advisor. They can provide expert guidance tailored to your specific circumstances and help you develop a personalized debt management plan.

Final Thoughts

Get the Latest & Recommended articles in your Inbox

Managing and eliminating debt is a journey that requires discipline, determination, and a solid strategy. By assessing your situation, creating a budget, prioritizing your debts, and exploring various repayment methods for both credit card and loan obligations, you can pave the way to a debt-free life. Remember that everyone's financial journey is unique, so choose the strategies that work best for you and stay committed to your goal. With patience and persistence, you can successfully climb out of the red and build a brighter financial future.Copyrights © 2024 Inspiration Unlimited eMagazine

Any facts, figures or references stated here are made by the author & don't reflect the endorsement of iU at all times unless otherwise drafted by official staff at iU. This article was first published here on 11th November 2023.