Special Features

A collection that's special to our readers, contributors and us especially for special news.

Ad

Top 5 Banks Fixed Deposits in India 2023

One of the most common ways to save money and earn returns is Fixed Deposit schemes with the banks. They are the safest option that assures consistent interest rates, special interest rates for senior citizens, multiple interest payment options, no market risks, and tax deductions.

Before investing in an FD or renewing the existing one, the depositor should evaluate the most recent fixed deposit rates offered by the top banks. Let us know the top 5 banks and their interest rates.

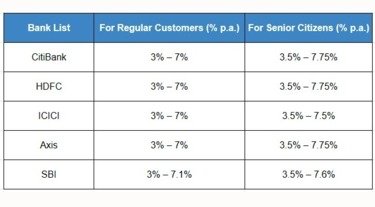

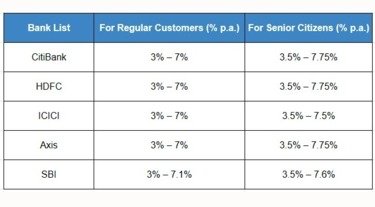

Top 5 Banks and their Interest Rates:

*FD interest rates are subject to change.

*FD interest rates are subject to change.

How to Open an FD Account?

Fixed Deposit accounts can be opened either online or offline. Mentioned below are the ways to open an FD Account:

A) Online Mode:

- Log in to the net banking of selected banks.

- Click on “Open a Fixed Deposit Account”.

- Fill up the online application form with the relevant information.

- Upload the soft copy of the required documents.

- Provide the nominee details.

- Transfer the amount to be invested to complete the application.

B) Offline Mode:

- Visit any nearest branch of the respective bank.

- Fill out for FD Application Form with all the relevant details.

- Attach all documents required along with the application form and submit them.

- Provide Cheque/ Cash for transferring the amount of Fixed Deposit.

- Once the application is processed, the account gets opened within the timeline of the bank.

Features & Benefits

Features & Benefits

Let us now discuss the features and benefits of the Top 5 banks fixed deposits:

i) CitiBank Fixed Deposit

- Fixed Deposits offer a higher rate of returns as compared to savings accounts.

- They are considered to be the safest as they assure stable interest rates and guaranteed returns.

- There is no risk of loss of principal.

- It gives an option to opt for periodic interest payouts which can be an additional source of income.

- The returns are not affected by market fluctuations ensuring great safety.

ii) HDFC Fixed Deposit

- Senior citizens get an additional off of 0.50% over regular rates.

- The minimum deposit amount required is INR 5000.

- The bank provides a nomination facility as well.

- HDFC provides an attractive rate of interest with an FD Account.

- Sweep-in and super saver facility is available with FD Account.

- The depositor can also earn compound interest by reinvesting the principal amount along with the interest amount earned on the FD.

iii) ICICI Bank Fixed Deposit

- It is a safe investment option that provides assured returns on investments.

- It offers its customers a wide range of FD tenure ranging from 7 days to 10 years making the tenure flexible.

- As it is an extremely liquid investment product, one can get it closed partially or completely before the maturity date. This helps to get the FD amount credited to the savings bank account in case of emergencies.

- Senior citizens can get an additional 0.5% of additional interest rate over and above the regular FD Rates.

- ICICI Bank offers overdraft against FD of up to 90% on principal plus accrued interest.

- The FD can be put on auto renewal mode to ensure that the FD gets renewed for the same tenure on the maturity date without any manual intervention and no interest loss.

iv) Axis Bank Fixed Deposit

- The minimum FD amount is INR 10,000 only.

- The tenure can be chosen ranging from 7 days to 10 years. The interest rates will vary depending on the deposit tenure being chosen. Also, the Axis Bank FD Calculator will help to calculate the maturity amount and the interest amount for different deposit amounts and tenures.

- The process to open an FD account is simple and hassle-free.

- The depositor can choose the time to receive interest i.e. on a monthly, quarterly, semi-annual, or annual basis while opening an FD account.

- The auto-renewal facility is also available.

v) State Bank of India Fixed Deposit

v) State Bank of India Fixed Deposit

- The SBI FD tenures range from 7 days to 10 years.

- The minimum deposit amount needed to open an FD in SBI is INR 1000, however, there is no limit on the maximum deposit.

- Senior citizens can avail of a 0.50% extra SBI FD interest rate for an amount exceeding INR 10,000.

- SBI provides a nomination facility so that the depositor can nominate his/her family members or spouse to collect the maturity amount.

- The auto-renewal facility is available on the deposit.

- A loan against the FD facility is also available

- TDS is deducted at the prevalent rate at source if Form 15G/15H is not submitted.

- An FD can be opened either online or offline. Earlier SBI Anywhere App was used for mobile banking, but as the same has been discontinued, now SBI YONO can be downloaded for SBI Mobile Banking.

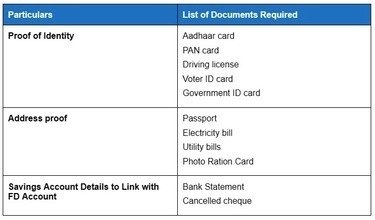

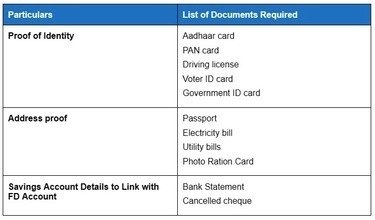

Documents Required

Mentioned below is the list of documents required to open a FD:

Eligibility Criteria

Mentioned below are the eligibility criteria to open an FD. There may be additional criteria that are specific to banks.

- Individuals who are resident Indians

- Joint account by two or more Individuals

- Senior citizens

- Minors

- Blind people

- Illiterate people

- Non-Resident Indians (NRIs)

- Sole proprietorship companies

- Societies, trusts, clubs, associations, etc.

- Religious and educational institutions

- Companies

- Partnership firms

How to Use FD Calculator?

An FD Calculator works with a formula to calculate the maturity amount for Fixed Deposits. An applicant is required to provide details like FD amount, Tenure, and Rate of Interest, to determine the maturity amount. Let us have a look at the formula used for this calculation:

A= P(1+r/n)^n*t

In the above formula,

‘A’ stands for the fixed deposit maturity amount

‘P’ stands for the amount you invest in the FD

‘r’ stands for the HDFC Bank FD rates

‘n’ stands for the number of times interest on an FD is calculated. ‘N’ can equal ‘1’ if the interest is calculated annually, ‘2’ if calculated half-yearly, ‘4’ if calculated quarterly, and

‘12’ if calculated every month

Before investing in an FD or renewing the existing one, the depositor should evaluate the most recent fixed deposit rates offered by the top banks. Let us know the top 5 banks and their interest rates.

Top 5 Banks and their Interest Rates:

*FD interest rates are subject to change.

*FD interest rates are subject to change.How to Open an FD Account?

Fixed Deposit accounts can be opened either online or offline. Mentioned below are the ways to open an FD Account:

A) Online Mode:

- Log in to the net banking of selected banks.

- Click on “Open a Fixed Deposit Account”.

- Fill up the online application form with the relevant information.

- Upload the soft copy of the required documents.

- Provide the nominee details.

- Transfer the amount to be invested to complete the application.

B) Offline Mode:

- Visit any nearest branch of the respective bank.

- Fill out for FD Application Form with all the relevant details.

- Attach all documents required along with the application form and submit them.

- Provide Cheque/ Cash for transferring the amount of Fixed Deposit.

- Once the application is processed, the account gets opened within the timeline of the bank.

Features & Benefits

Features & BenefitsLet us now discuss the features and benefits of the Top 5 banks fixed deposits:

i) CitiBank Fixed Deposit

- Fixed Deposits offer a higher rate of returns as compared to savings accounts.

- They are considered to be the safest as they assure stable interest rates and guaranteed returns.

- There is no risk of loss of principal.

- It gives an option to opt for periodic interest payouts which can be an additional source of income.

- The returns are not affected by market fluctuations ensuring great safety.

ii) HDFC Fixed Deposit

- Senior citizens get an additional off of 0.50% over regular rates.

- The minimum deposit amount required is INR 5000.

- The bank provides a nomination facility as well.

- HDFC provides an attractive rate of interest with an FD Account.

- Sweep-in and super saver facility is available with FD Account.

- The depositor can also earn compound interest by reinvesting the principal amount along with the interest amount earned on the FD.

iii) ICICI Bank Fixed Deposit

- It is a safe investment option that provides assured returns on investments.

- It offers its customers a wide range of FD tenure ranging from 7 days to 10 years making the tenure flexible.

- As it is an extremely liquid investment product, one can get it closed partially or completely before the maturity date. This helps to get the FD amount credited to the savings bank account in case of emergencies.

- Senior citizens can get an additional 0.5% of additional interest rate over and above the regular FD Rates.

- ICICI Bank offers overdraft against FD of up to 90% on principal plus accrued interest.

- The FD can be put on auto renewal mode to ensure that the FD gets renewed for the same tenure on the maturity date without any manual intervention and no interest loss.

iv) Axis Bank Fixed Deposit

- The minimum FD amount is INR 10,000 only.

- The tenure can be chosen ranging from 7 days to 10 years. The interest rates will vary depending on the deposit tenure being chosen. Also, the Axis Bank FD Calculator will help to calculate the maturity amount and the interest amount for different deposit amounts and tenures.

- The process to open an FD account is simple and hassle-free.

- The depositor can choose the time to receive interest i.e. on a monthly, quarterly, semi-annual, or annual basis while opening an FD account.

- The auto-renewal facility is also available.

v) State Bank of India Fixed Deposit

v) State Bank of India Fixed Deposit- The SBI FD tenures range from 7 days to 10 years.

- The minimum deposit amount needed to open an FD in SBI is INR 1000, however, there is no limit on the maximum deposit.

- Senior citizens can avail of a 0.50% extra SBI FD interest rate for an amount exceeding INR 10,000.

- SBI provides a nomination facility so that the depositor can nominate his/her family members or spouse to collect the maturity amount.

- The auto-renewal facility is available on the deposit.

- A loan against the FD facility is also available

- TDS is deducted at the prevalent rate at source if Form 15G/15H is not submitted.

- An FD can be opened either online or offline. Earlier SBI Anywhere App was used for mobile banking, but as the same has been discontinued, now SBI YONO can be downloaded for SBI Mobile Banking.

Documents Required

Mentioned below is the list of documents required to open a FD:

Eligibility Criteria

Mentioned below are the eligibility criteria to open an FD. There may be additional criteria that are specific to banks.

- Individuals who are resident Indians

- Joint account by two or more Individuals

- Senior citizens

- Minors

- Blind people

- Illiterate people

- Non-Resident Indians (NRIs)

- Sole proprietorship companies

- Societies, trusts, clubs, associations, etc.

- Religious and educational institutions

- Companies

- Partnership firms

How to Use FD Calculator?

An FD Calculator works with a formula to calculate the maturity amount for Fixed Deposits. An applicant is required to provide details like FD amount, Tenure, and Rate of Interest, to determine the maturity amount. Let us have a look at the formula used for this calculation:

A= P(1+r/n)^n*t

In the above formula,

‘A’ stands for the fixed deposit maturity amount

‘P’ stands for the amount you invest in the FD

‘r’ stands for the HDFC Bank FD rates

‘n’ stands for the number of times interest on an FD is calculated. ‘N’ can equal ‘1’ if the interest is calculated annually, ‘2’ if calculated half-yearly, ‘4’ if calculated quarterly, and

‘12’ if calculated every month

Get the Latest & Recommended articles in your Inbox

‘t’ stands for the tenure of the fixed depositCopyrights © 2024 Inspiration Unlimited eMagazine

Any facts, figures or references stated here are made by the author & don't reflect the endorsement of iU at all times unless otherwise drafted by official staff at iU. This article was first published here on 15th October 2023.