Start-ups Place

A perfect marketing place for start-ups & inspiration for starters. We know what it takes to start-up hence we support those that do.

Ad

Trade Lenda: Empowering Small Businesses in Africa with Innovative Financial Solutions

Amidst the bustling world of entrepreneurship, Micro, Small, and Medium Enterprises (MSMEs) have long struggled to secure timely credit for restocking inventory or purchasing supplies. The lack of support from traditional financial institutions, often demanding upfront collateral that MSMEs cannot provide, has posed significant challenges for these small businesses to grow and thrive.

Amidst the bustling world of entrepreneurship, Micro, Small, and Medium Enterprises (MSMEs) have long struggled to secure timely credit for restocking inventory or purchasing supplies. The lack of support from traditional financial institutions, often demanding upfront collateral that MSMEs cannot provide, has posed significant challenges for these small businesses to grow and thrive.In response to this pressing issue, Trade Lenda emerged as a beacon of hope for MSMEs.

Join us as we delve into the story of Trade Lenda, a trailblazing company that is shaping the future of SME finance and empowerment.

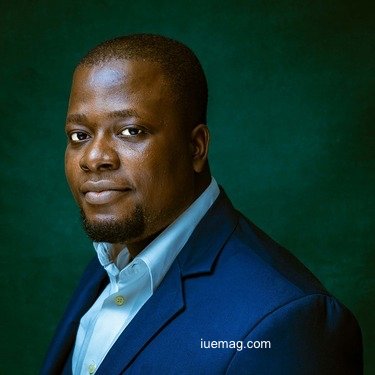

Introducing the Visionary Founders

In the dynamic world of startups, 3 visionary entrepreneurs from Nigeria are leading the charge at Trade Lenda - Adeshina Adewumi, Shina Arogundade, and Oluwatosin Ayodele. Together, they share a passion for financial inclusion and are determined to make a positive impact on Micro, Small, and Medium Enterprises (MSMEs) across Africa.

Adeshina Adewumi, the CEO and founder, brings invaluable experience in financial services and venture-backed startups, he is a 2x founder. Joining him is COO and co-founder Shina Arogundade, who contributes his expertise in risk management and credit underwriting across 20 African countries. Completing the trio is Oluwatosin Ayodele, a skilled full-stack engineer, and co-founder, whose focus is on developing sustainable financial services solutions for both the public and private sectors. He is also a 2x founder with awards nationally.

A Vision Rooted in Empowerment

A Vision Rooted in EmpowermentAt the core of Trade Lenda lies a profound vision - empowering MSMEs across Africa through microfinance, particularly in the realms of inventory finance and invoice finance.

Trade Lenda's breakthrough technology addresses the pain points faced by small businesses in securing credit. Traditional financial institutions often shy away from supporting SMEs without upfront collateral, leaving them in a difficult situation. However, Trade Lenda's innovative approach allows them to underwrite these businesses based on their unique data and circumstances. This underwriting process enables Trade Lenda to provide microfinance solutions in the form of inventory financing or invoice financing, giving small businesses the much-needed support to thrive and grow.

The idea took root from Adeshina's prior experience at One Kiosk Inc., where he witnessed countless businesses thriving, achieving a cumulative monthly GMV of $1 million. However, these businesses faced growth limitations due to the lack of timely credit for restocking inventory and supplies. He also recollects his mother's struggles to scale her own business due to limited access to credit.

A Target Market with Significance

Trade Lenda's focus centers on supporting SMEs in the Fast Consumer Goods, Agro Commodities, and General Merchandise sectors in Africa. This niche approach allows them to develop a robust algorithm that can eventually support a broader range of SMEs as the company scales its operations. By tapping into high-performing sectors, Trade Lenda aims to make a meaningful impact on the lives of small business owners, empowering them to play a more significant role in economic growth and prosperity.

Overcoming Challenges and Seeking Funding

Overcoming Challenges and Seeking FundingThe path to success was not without its challenges. Early on, securing initial funding for their microfinance services proved to be a daunting task. However, the founders demonstrated their tenacity and resourcefulness by leveraging their network of High Net-worth Individuals to bridge the financial gap. As Trade Lenda's reputation grew, they forged strong relationships with more substantial institutions, solidifying their funding capabilities.

Maintaining a Competitive Edge

What sets Trade Lenda apart from others in the industry is its pioneering design of APIs for MSME lending services, with a specific focus on the key performing sectors they serve. This streamlined process empowers SMEs with faster access to credit, ensuring timely support for their business needs. Trade Lenda's commitment to innovation and staying ahead in the game ensures that they remain at the forefront of the financial inclusion landscape.

Current Funding and Notable Achievements

Trade Lenda's journey has been fueled by the support of Angels and Venture Capital firms such as Expert Dojo, ARM Group, Sovereign Capital, and others. Within the first 18 months, they have already made a significant impact, supporting over 240,000 SMEs with various financial services and inclusion trainings. Additionally, they have disbursed over $2 million in microfinance within their first full year of operation. They are on their path to 10x that number in 2023.

Future Metrics and Expansion Plans

Future Metrics and Expansion PlansTrade Lenda envisions substantial growth in the next five years, with an ambitious goal of achieving over $100 million in Annual Recurring Revenue (ARR). Their vision extends beyond the borders of Nigeria, as they plan to expand their presence across multiple countries in Africa, Europe, and North America. By scaling their operations, Trade Lenda aims to make a global impact in empowering SMEs worldwide.

Entrepreneurship: A Continuous Learning Journey

For the founders of Trade Lenda, entrepreneurship is not just a career choice; it is a continuous learning journey. Embracing change, nurturing growth, and staying customer-centric are the pillars that fuel their success. They believe that each day presents new opportunities to grow and pivot, and their dedication to learning ensures that their company keeps evolving.

Advice for Aspiring Entrepreneurs

As seasoned entrepreneurs, the founders of Trade Lenda have valuable advice for those starting their own journey. They emphasize the importance of being open-minded, solving real-life problems, and involving customers in the development process. They encourage aspiring entrepreneurs to understand that entrepreneurship is not without its challenges, but with the right solution and the right team, the efforts become worthwhile and rewarding.

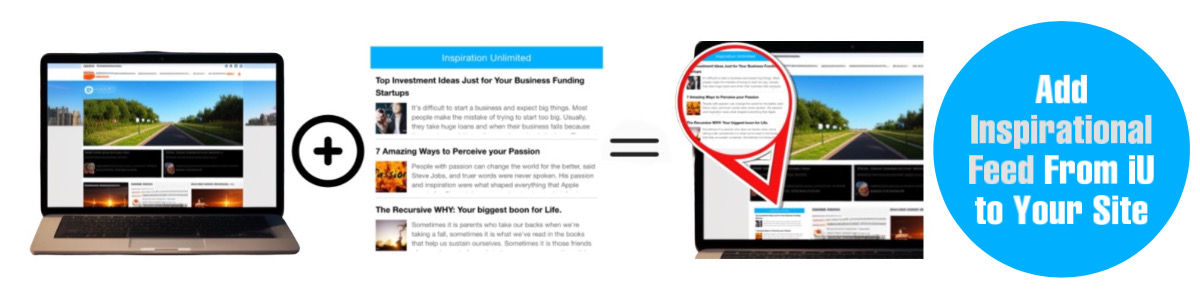

Get the Latest & Recommended articles in your Inbox

Trade Lenda's Story: Empowering SMEs One Step at a TimeFrom humble beginnings to a rapidly growing force in the world of financial inclusion, Trade Lenda's story is an inspiring tale of innovation, perseverance, and dedication to making a positive impact. Their technology-driven microfinance solutions are transforming the lives of countless small business owners, empowering them to thrive and contribute to the growth of their communities. As Trade Lenda continues its journey, they remain committed to the vision of empowering SMEs, one step at a time.

Copyrights © 2024 Inspiration Unlimited eMagazine

Any facts, figures or references stated here are made by the author & don't reflect the endorsement of iU at all times unless otherwise drafted by official staff at iU. This article was first published here on 6th September 2023.